Monthly Report: June 2022

May market volatility illustrates the ‘tug of war’ market participants are currently experiencing.

On one side we have inflation; on the other side we have the risk of recession.

Every data point, headline, and forecast is analyzed as economists attempt to project which side will prevail.

With all of the volatility some may find it hard to believe the S&P 500, Dow Jones Industrial Average, Russell 1000 Value, and Russell 2000 all ended the month in positive territory. The S&P 500 began the month in positive territory, then dropped by over -9%, and then gained over +6% to turn slightly positive by month’s end.

At the same time, the Aggregate Bond Index was positive for the month. This was the first time this year bond prices increased (bonds have had the worst start to begin any year).

Year to date (through 5/31/2022):

- the Dow is down -9.21%1,

- the S&P 500 is -13.30%1 lower,

- the NASDAQ is in bear market territory at -22.78%1.

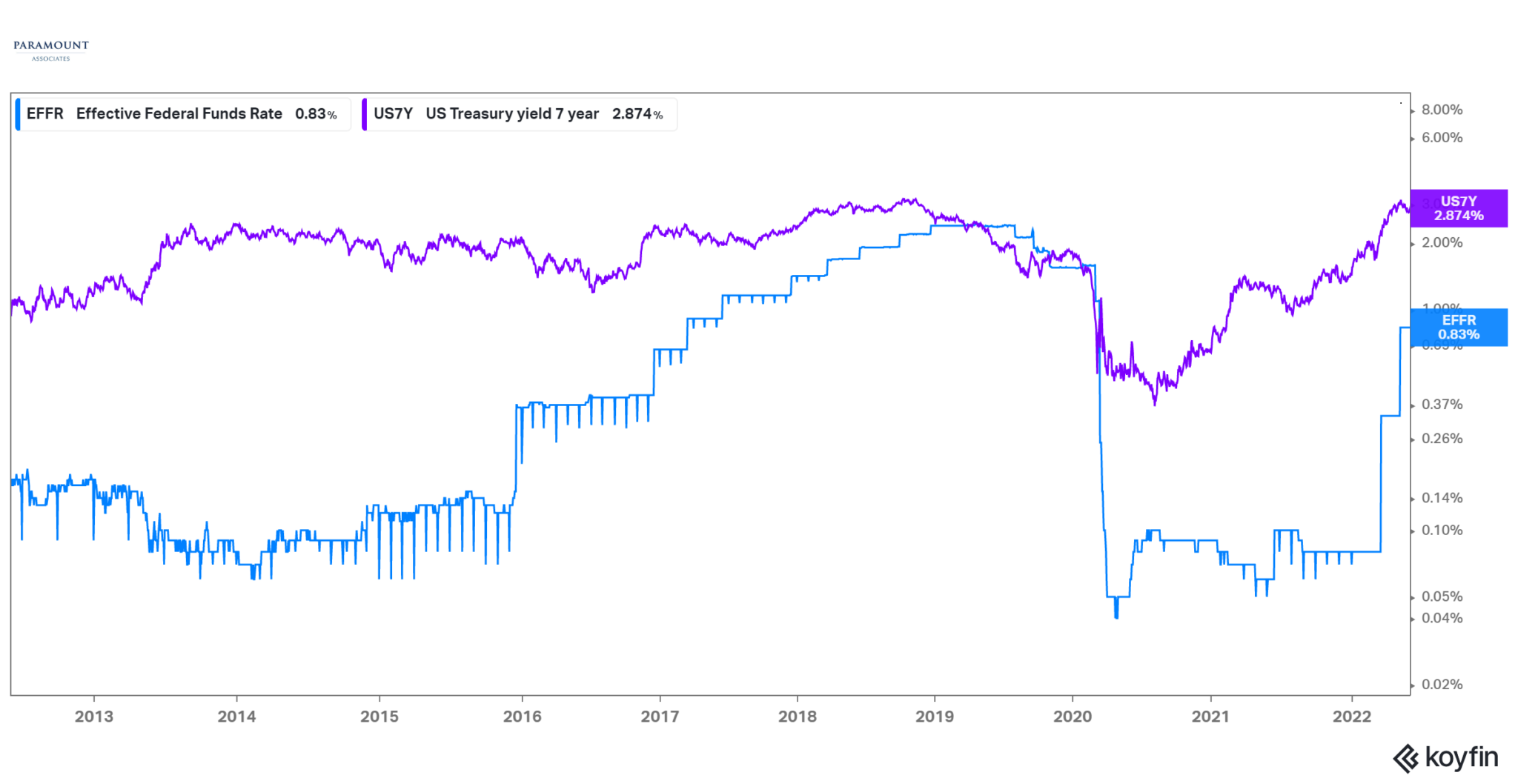

As the economic cycle progresses it is necessary for the Federal Reserve to raise interest rates. This happens every few years. Mechanically, the bond market anticipates the Federal Funds Rate (as shown in the chart2 below). The Federal Reserve uses interest rates to either cool an economy or to help stimulate an economy when in an economic downturn. Today, the Federal Reserve finds itself in a predicament where combating high inflation is the main concern. As rates rise, money becomes more expensive to obtain and the supply of money in the economy shrinks. Less money supply reduces corporate profits, reduces the purchasing power of the consumer, and slows the overall economy.

In early May, the fed funds futures market anticipated a 2.8%3 Federal Funds Rate by the end of 2022. The most recent forecasts have reduced to 2.6%3. We have seen these indicators move bonds as much as stocks this year. In early May the 10-Year Treasury Rate topped 3% for the first time since 2018. Remember that in February the 10-Year Treasury Rate was as low as 1.7%. A difference of +1.3% doesn’t sound like a market moving change; however, in reality the market reacts to changes on a ‘percentage change’ basis. Using the numbers above, rates increased over 75% in just a few months. This illustrates the hard time bond prices have had this year. Bond prices move inversely to bond yields; as yields increase the price of bonds decreases by it’s own sensitivity to interest rates (this is measured by the Duration of the bond or bond portfolio).

When bonds prices are falling and stock prices are falling at the same time, bonds do not provide the diversification aspects they normally do. In the last three weeks we have seen some positive diversification from the bond markets, as the risk of recession has entered the conversation.

Stock markets attempt to predict rates similarly to bond markets. The overall market level, the types of companies that outperform, and the daily volatility are all ways that the stock market prices in the Federal Funds Rate expectations. The focus of the above discussion was the bond market, however stock markets also price in changes to interest rates.

Here is what we think regarding Inflation and/or Recession:

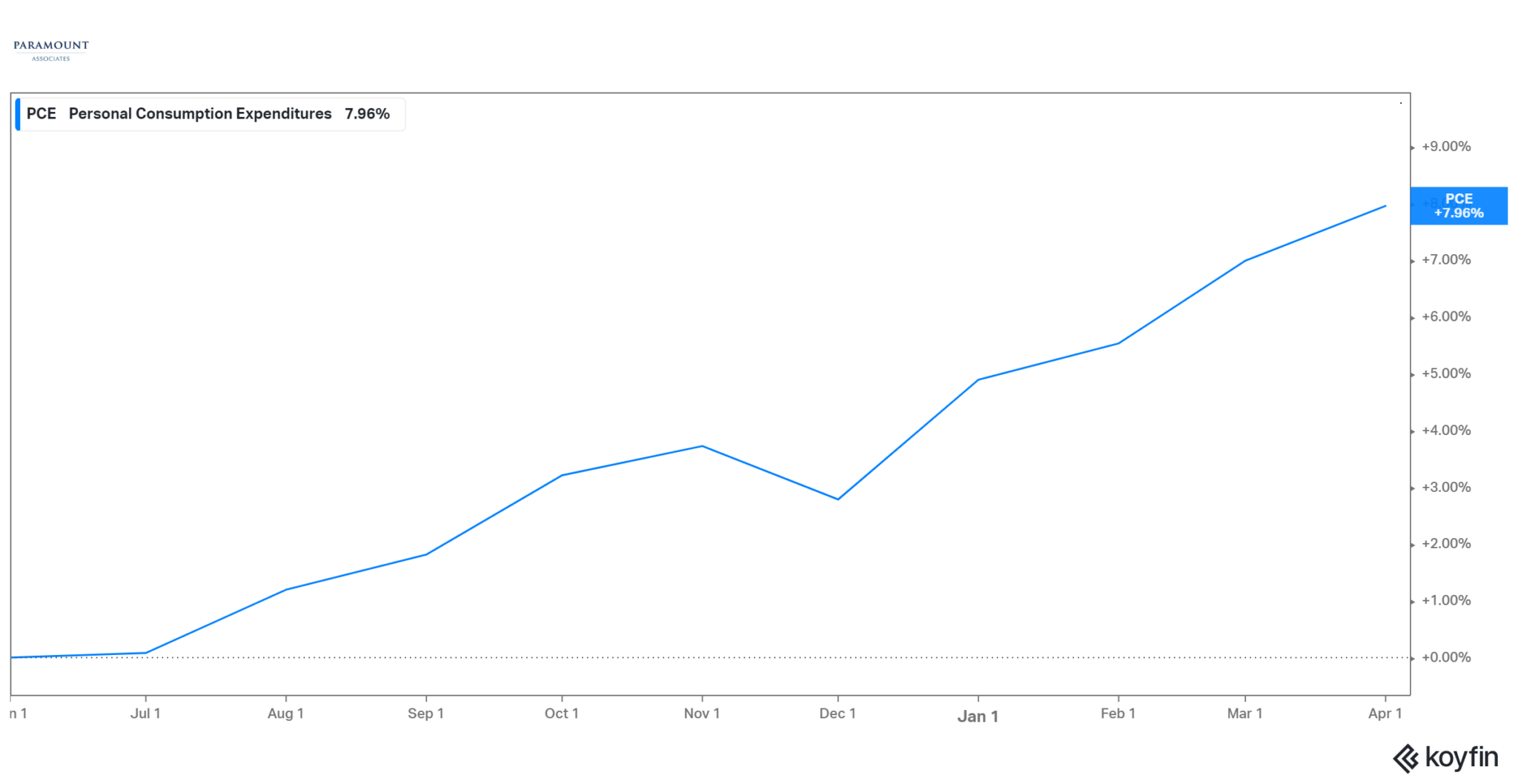

Inflation will naturally reduce as demand begins to waiver. There is evidence (Walmart, Target, Costco to name a few) that lower income households are spending less and the rising price of goods is cutting into retail margins. There is a point where the consumer is unwilling to purchase goods at increased prices. We have seen this in the housing market as home prices and mortgages have become more expensive. When it is more difficult and more expensive to get money, demand should falter. The Federal Reserve will raise rates until there is evidence that inflation is under control and we expect that sooner than the markets are anticipating.

Has Inflation Peaked2?

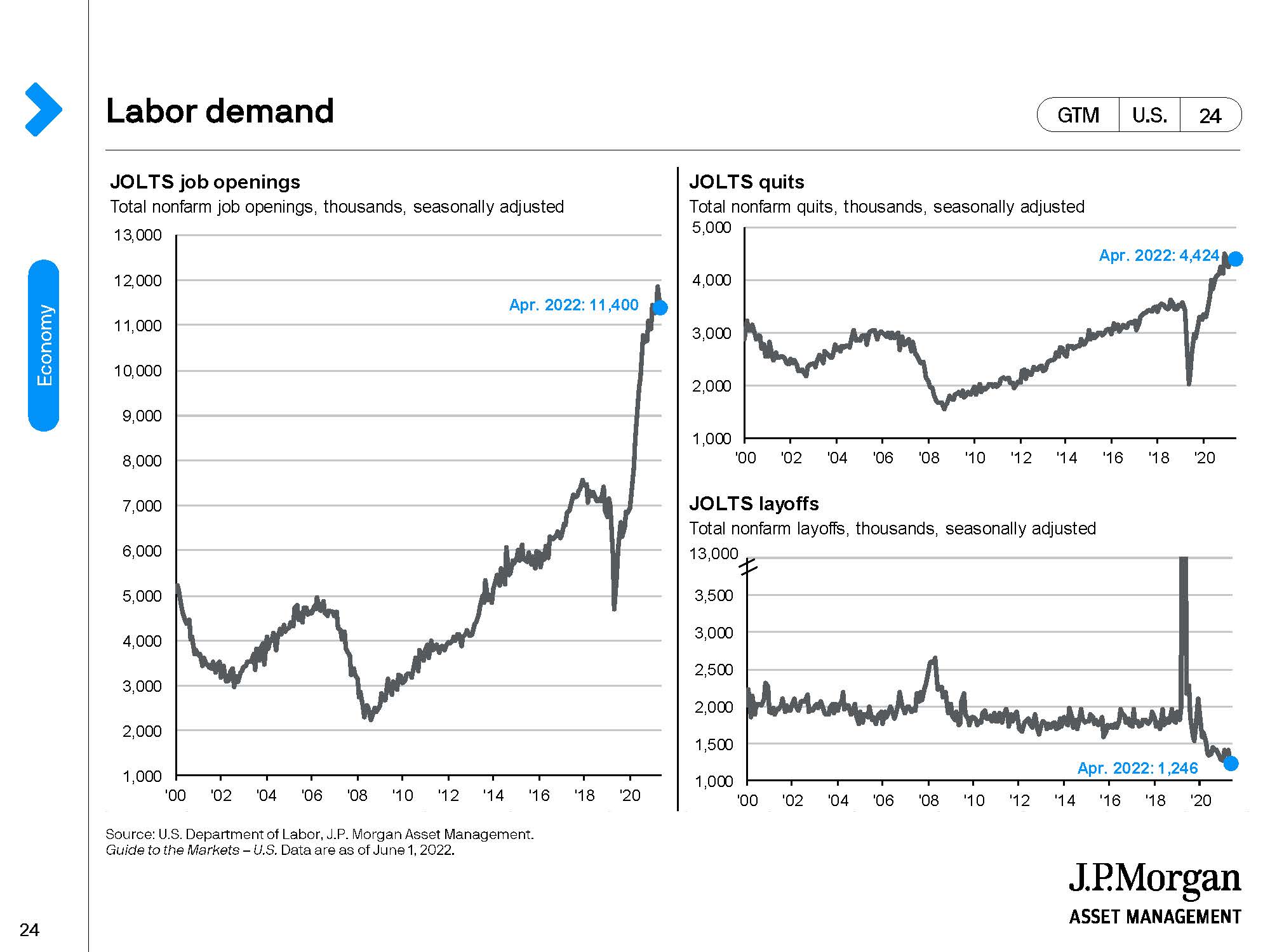

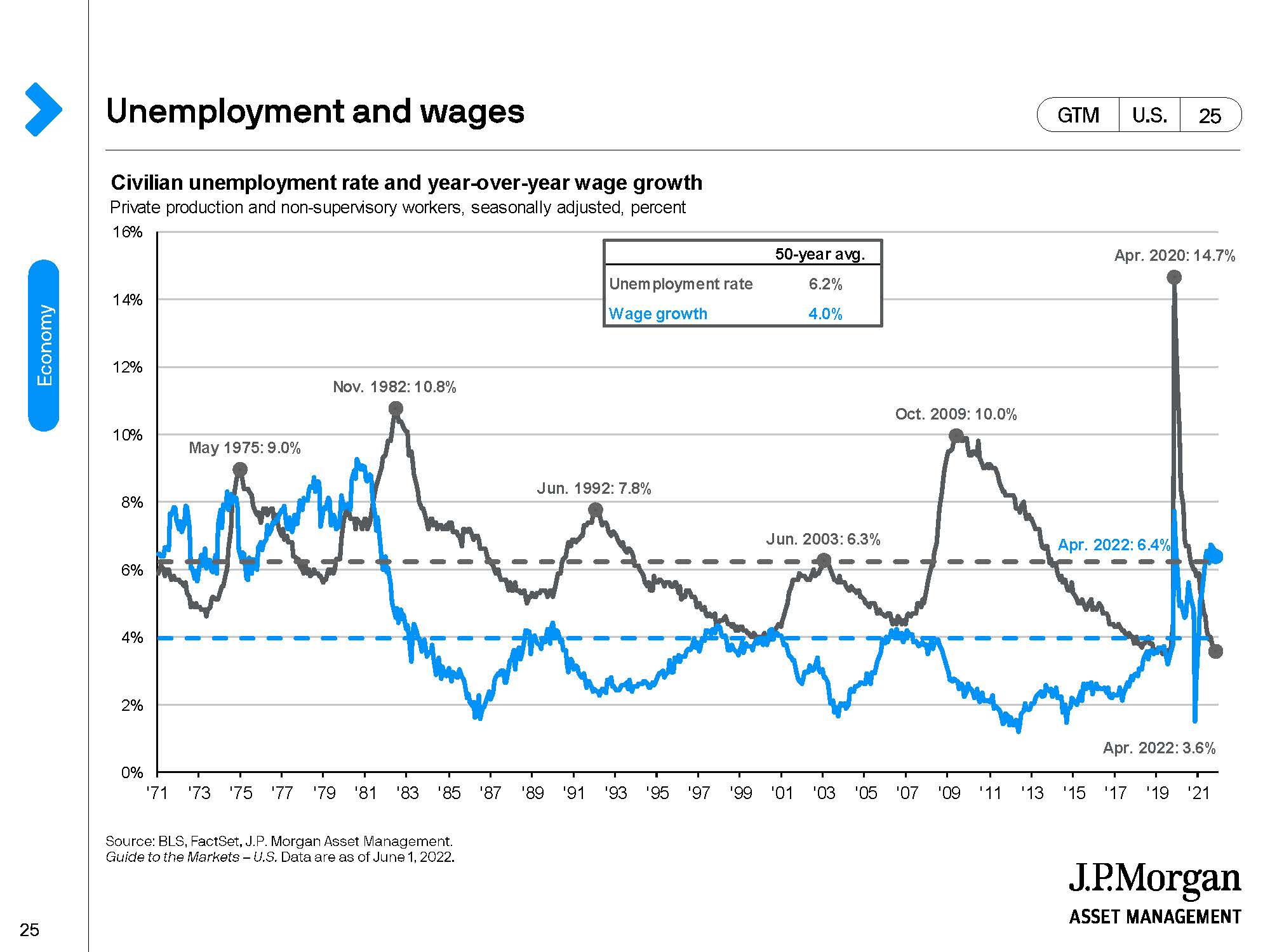

We do not believe the United States will enter a Recession in 2022. Why? One answer – Employment. Even with job openings falling by 455,0004 in April, there are 5.464 million more open jobs than available workers. Also, this is after 4.4 million workers left their positions in April as the “Great Resignation” continues. Openings are up, quits are up, and layoffs are at the lowest levels in over 20 years5. The unemployment rate decreased to 3.5%4 even with 4.4 million workers leaving their jobs and openings falling by roughly 500,000 – that is an incredibly strong US labor market.

With a tight labor market employees are able to demand higher wages. We are seeing robust earnings growth like we haven’t seen since the 1970s5.

WHERE DO WE GO FROM HERE?

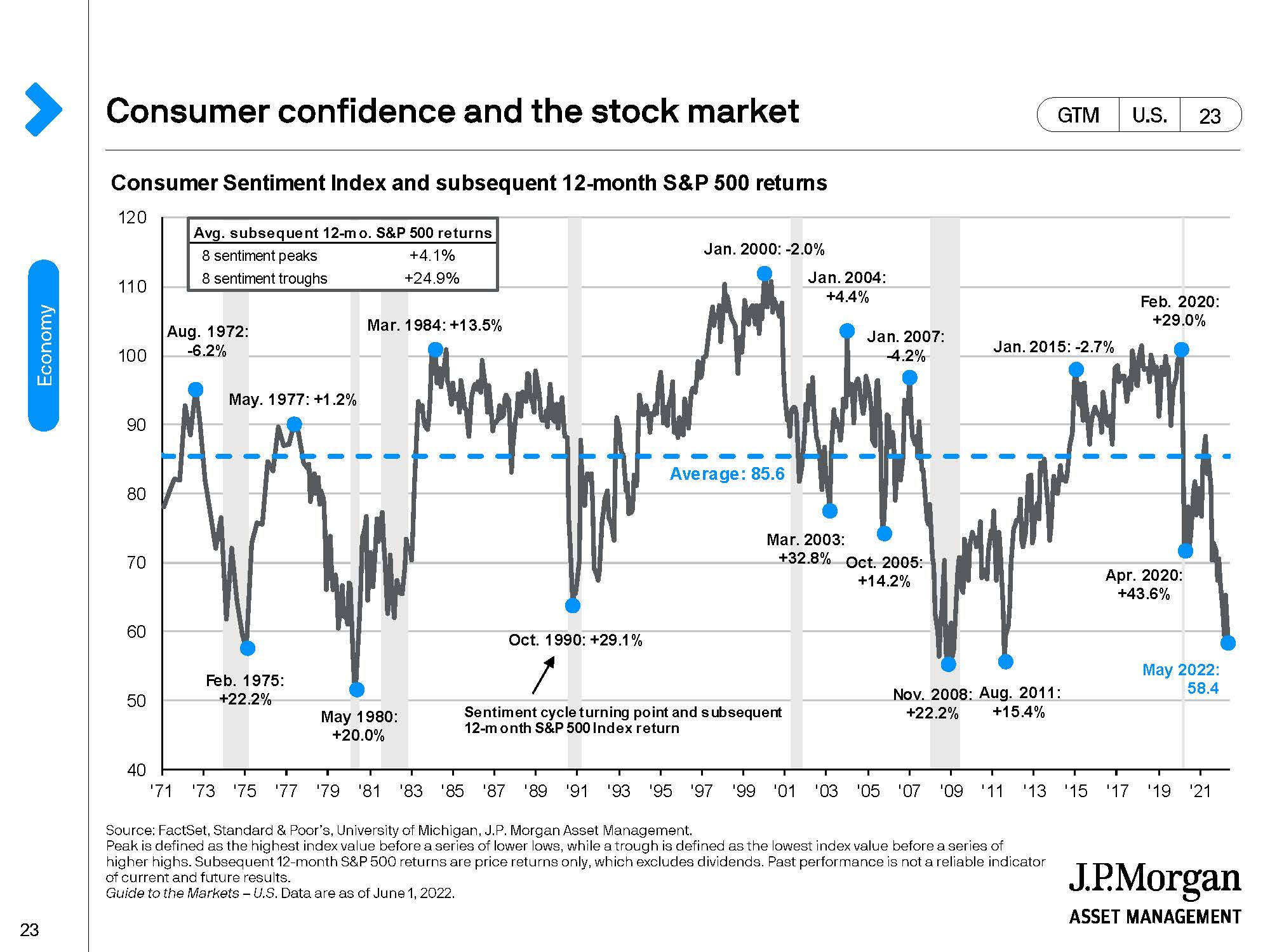

We expect the market (bond and stock) volatility to continue. We expect the stock market and bond markets to both appreciate between now and the end of the year. We are not necessarily calling a bottom, but we are fundamentally ready to increase allocations to risk assets. Risk assets is a broad category and will differ based on the economic cycle. We are considering different assets today than during the pandemic market reaction. Remember, the best buying opportunities for risk assets are when the consensus is most negative5.

REFERENCES

1Morningtar.com/markets; accessed 6/02/2022

2Koyfin.com; accessed 6/02/2022

3Morgan Stanley; The GIC Weekly; Global Investment Committee; accessed 5/31/2022

4CNBC; Job openings show sharp decline, but still vastly outnumber available workers; Jeff Cox; accessed 6/01/2022

5JP Morgan; Guide to the Markets As of June 1, 2022; Global Market Insights Strategy Team; accessed 6/01/2022

DISCLAIMER

The views expressed represent the opinion of Paramount Associates. The views are subject to change and are not intended as a forecast or guarantee of future results. This material is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. Stated information is derived from proprietary and non-proprietary sources believed to be correct and current, but it should not be regarded as complete, an endorsement or personalized investment advice. Forward looking statements are speculative and based on assumptions as well as known and unknown risk and uncertainties. Past performance is not indicative of future results. The appropriate- ness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Nothing contained herein constitutes financial, legal, tax, or any other type of advice. A professional advisor should be consulted before implementing any investment strategy.

Paramount Associates

6400 S. Fiddlers Green Circle Suite 1310

Greenwood Village, CO 80111

(720) 463-0020

general@paramountassoc.com

www.paramountassoc.com

www.linkedin.com/in/paramount-associates-623692197

@paramountassociatesdenver